Over the past few weeks, I've been diagnosing fundamental flaws in today's carbon removal market design. The response has been significant – founders, investors, and industry leaders across the space have reached out sharing their own experiences with the same structural barriers. Earlier this week I presented to hundreds of live viewers on the This is CDR podcast about Carbon Removal’s Wrong Turn.

But diagnosing the problem isn't enough. We need to build something better.

What is clear to me after ten years in carbon removal is that we're not facing mere implementation challenges – we're confronting a fundamental category design problem. The carbon removal market of today is structurally incapable of reaching gigatonne scale because it was never designed for that purpose.

Why Our Current Approach Is Failing

Look at the reality: Microsoft represents over 60% of all carbon removal purchases. We have 500+ carbon removal startups competing for a handful of corporate buyers. And we're measuring carbon removal success based on accounting precision (i.e “high-quality credits”) rather than atmospheric impact.

These aren't implementation problems – they're category design failures.

When I was building Nori in 2019, one of our Techstars mentors introduced me to the book Play Bigger, which fundamentally changed how I thought about our challenge. It helped me recognize that we've inherited the DNA of carbon offsets and are trying to retrofit carbon removal into frameworks that were never meant to scale beyond corporate sustainability departments.

Why Carbon Removal Needs Category Creation, Not Improvement

First, let's get clear on what category creation actually means.

The authors of Play Bigger argue that the most successful companies don't just create better products – they define and dominate entirely new market categories. Think Uber creating ridesharing or Salesforce pioneering cloud computing. These "category kings" don't just win by outcompeting others – they create games where the rules naturally favor them.

Category creation means simultaneously building three things:

A product that solves a problem in a new way

A company designed to deliver that solution

A market category that defines how people think about the problem

The fundamental insight is that the third element – category design – is just as important as the first two, yet founders and investors typically neglect it entirely.

This is precisely what's happening in carbon removal. We've inherited the DNA of carbon offsets and are trying to improve a fundamentally flawed model rather than creating something new.

Consider the problems I've highlighted in previous articles:

A monopsony of corporate buyers (Microsoft represents 60% of purchases, and furthermore, pretty much all buyers are in the form of corporate offtake agreements)

An obsession with perfect measurement and thousand-year permanence

The additionality trap that penalizes successful scaling

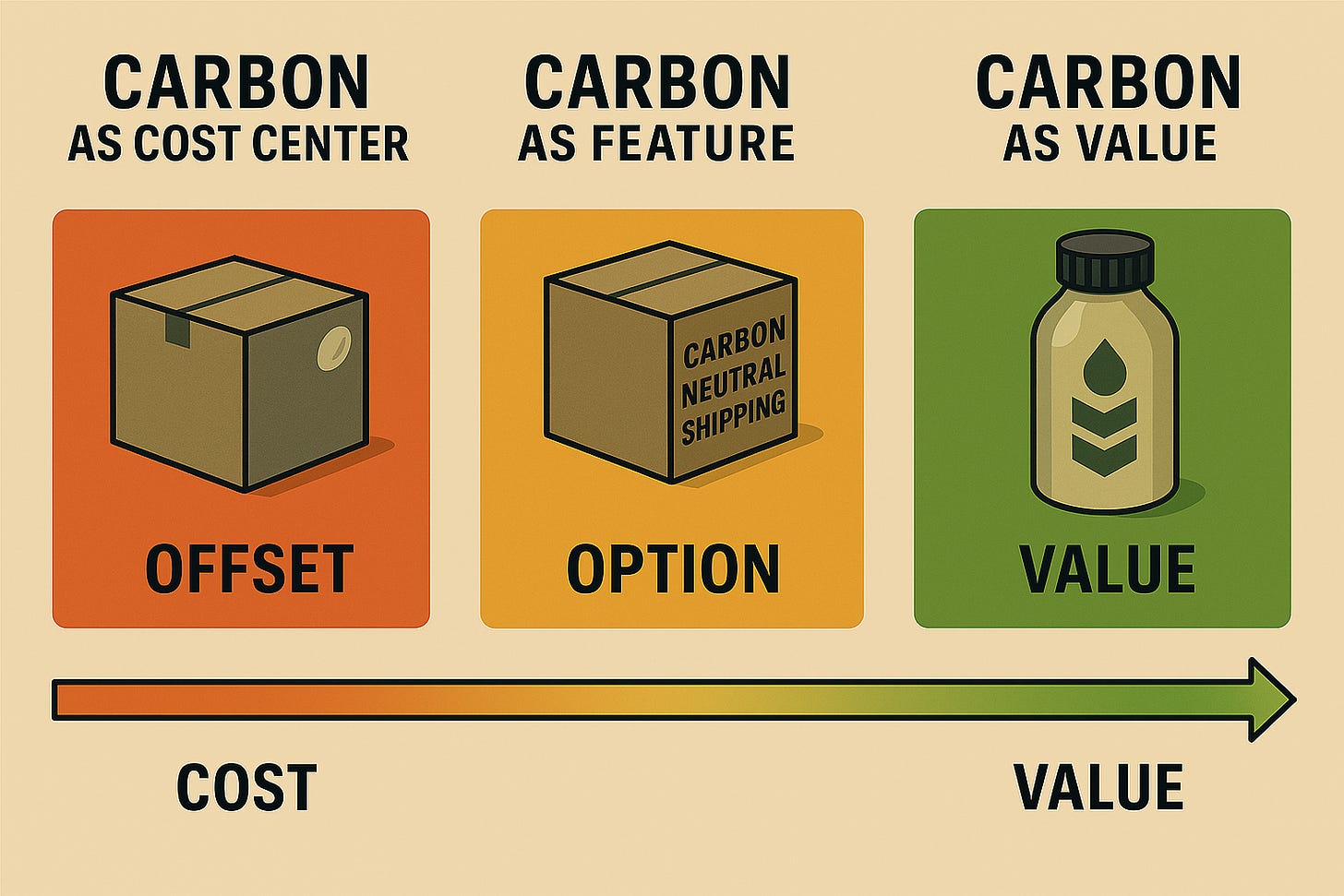

Financial structures that treat removal as a cost rather than a value creator

These aren't implementation problems – they're category design failures. We've tried to retrofit carbon removal into frameworks designed for avoidance offsets, and it simply doesn't work.

The Three Pillars of Category Design for Carbon Removal

Product Innovation: Strong But Not Enough On Its Own

The carbon removal industry has actually excelled in developing removal technologies – from direct air capture to enhanced weathering, from soil carbon to biomass burial. The methodology pipeline is diverse and promising.

But innovative technologies alone can't overcome poorly designed market structures. At Nori, we discovered this firsthand when our soil carbon methodology – technically sound and ready for scaling – struggled within market frameworks designed for traditional offsets.

Company Design: Trapped in Old Models

Here's where things get interesting. Most carbon removal companies are built to sell to a narrow slice of corporate sustainability departments with limited budgets and specific requirements. Their entire business models, sales approaches, and operational structures are built around this single customer profile.

What if instead of building companies that sell "offsets" to sustainability departments, we built companies that:

Embed carbon removal into consumer products as premium features

Create advertising-supported removal models

Develop financial instruments that engage CFOs rather than CSOs

Build loyalty programs that convert points to atmospheric impact

And et cetera. These approaches require fundamentally different company designs than what most carbon removal startups are building today.

Category Design: The Missing Piece

This is where we've most dramatically failed. We haven't created a unique category for carbon removal – we've allowed it to be perceived as just "premium offsets." This categorization brings all the baggage, limitations, and false equivalencies of offset markets.

I want to be especially clear on this point. Inside the CDR industry, we all know how distinct carbon removal is from carbon offsets. But when you read corporate sustainability reports or mainstream news articles, you will see carbon avoidance offsets and carbon removal purchases lumped together in the same “carbon accounting” framework. We are failing at defining this as something that is separate and different.

Effective category design means controlling how people think about your product. It means creating new language, new frameworks, and new metrics that reshape perception.

When people hear "carbon removal," they immediately think "expensive offsets" – a mental model that limits scaling potential. What if instead we framed carbon removal as "atmospheric restoration" – something valuable and necessary beyond offsetting emissions?

Making Carbon Removal Antifragile

One of the most impactful books I've read is Nassim Taleb's Antifragile. Taleb introduces a concept beyond merely being robust – being antifragile means actively benefiting from volatility and stress.

His classic example compares two brothers – one a corporate executive with a stable job and pension, the other a taxi driver with fluctuating daily income. When a crisis hits, the corporate executive loses everything, while the taxi driver adapts and learns from daily variability. The executive's income is fragile; the taxi driver's is antifragile.

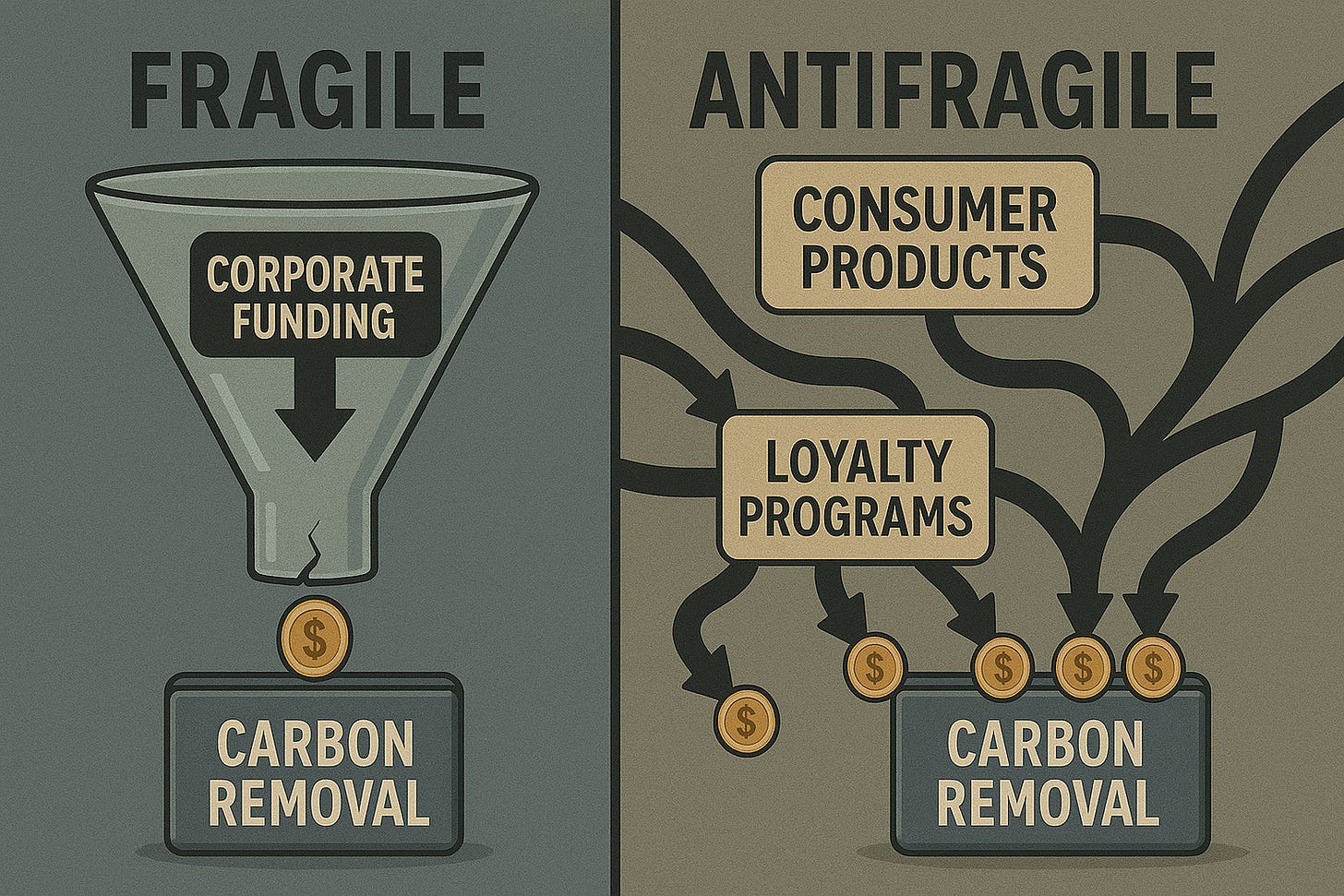

The carbon removal industry today is dangerously fragile. It depends on a monopsony of corporate buyers making discretionary purchases from limited sustainability budgets. When economic headwinds arise, these purchases are among the first to be cut.

Multiple Channels Create Resilience

What we need is to make carbon removal antifragile – creating multiple, diverse channels through which carbon removal gets funded. When one channel faces pressure, others can expand. The industry learns and adapts through this variability rather than collapsing.

I witnessed this principle in action at Nori. When the crypto industry became introspective about its environmental impact in 2020, we were uniquely positioned to capitalize as we were selling the only natively on-chain carbon removal credits. It felt like the beginning of finding product market fit. But when the 2022 crypto winter began, all that purchasing went away, and we were back to struggling alongside everyone else in attempting to sell to corporate buyers.

Beyond Corporate Offsetting

Carbon removal is undergoing a phase change. Phase one was driven by corporate offsetting – and perhaps that's the only way it could have gotten off the ground. Corporate buyers like Stripe, Microsoft, and Shopify set the stage so investors could say, "Yes, there will be a market for these solutions." But phase one is fundamentally incapable of scaling to gigatonnes.

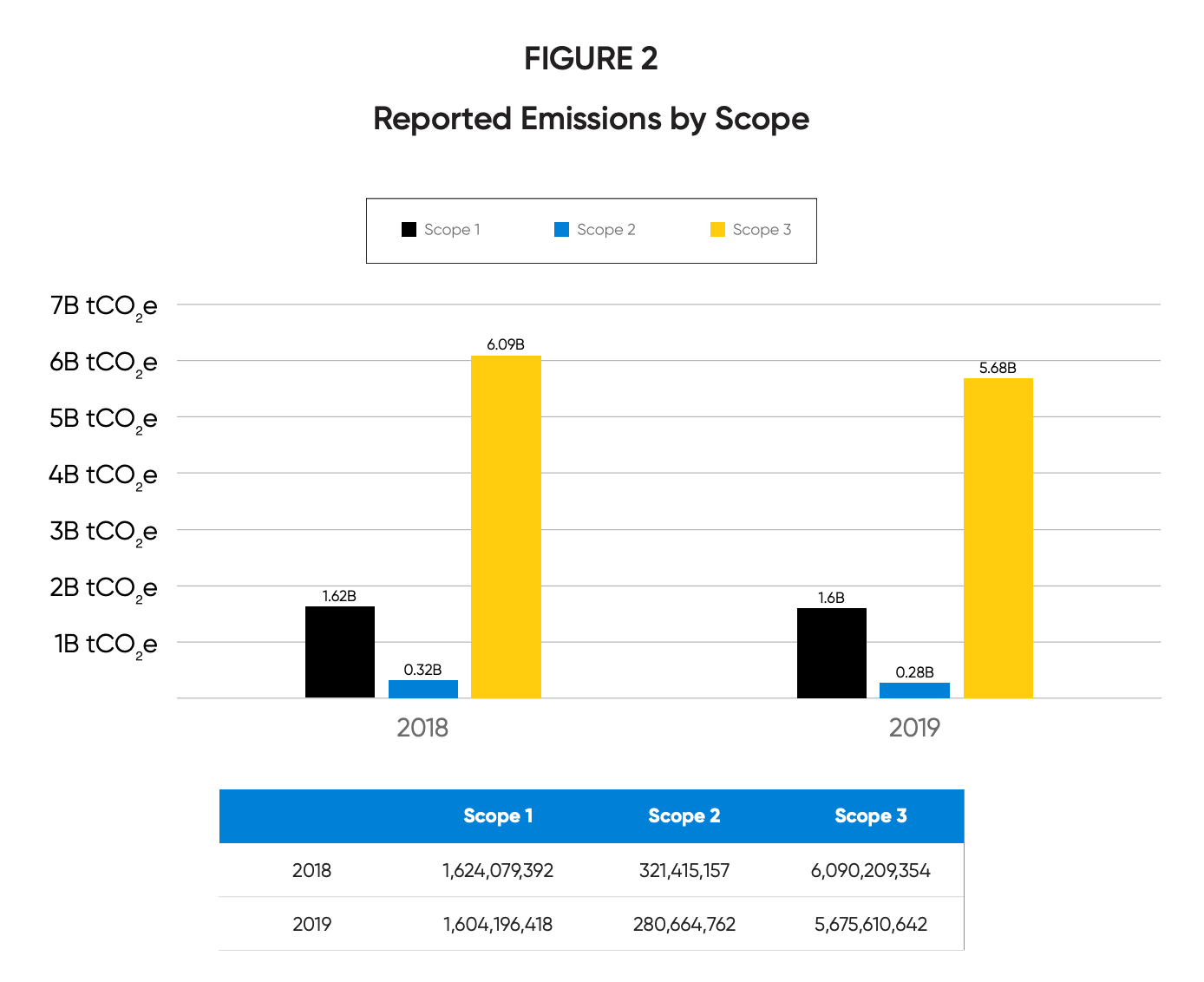

The math simply doesn't work for corporate buyers alone. Fortune 500 companies' combined Scope 1 and 2 emissions total about 2 billion tonnes according to Recapture. Even if every one of these companies paid for 100% removal of these direct emissions (which they won't), that's only 20% of the 10 billion tonnes we need annually by 2050. While many corporate net zero commitments include Scope 3 emissions, those indirect emissions represent a more complex funding challenge - they're ultimately someone else's direct emissions, creating potential for either double-counting or responsibility gaps. Regardless of how we account for Scope 3, the fundamental problem remains: traditional corporate offsetting models can't generate sufficient funding for the scale we need.

We need to move to the next phase by designing a new category for carbon removal – one where payments are distributed among corporations and consumers, where removal creates value rather than just offsetting emissions, and where multiple funding channels create antifragility.

Creating Lightning Strike Moments for Carbon Removal

Category creation isn't just about gradual evolution – it often requires what Play Bigger calls "lightning strike" moments – coordinated efforts that make a new category visible and credible all at once. Carbon removal was put on the map with Stripe’s 2019 funding commitment, and the announcement for Frontier Climate firmly cemented it. That was a lightning strike for phase one. But we need something new for the next phase.

Orchestrating Category Transformation

A successful category-creating moment for carbon removal would include:

Diverse Players: 3-5 leading carbon removal companies with different approaches, plus infrastructure partners, consumer brands, and credibility partners from research institutions.

Clear New Message: A unified definition of the problem beyond "offsetting emissions" and new metrics that prioritize atmospheric impact over accounting precision.

Working Examples: Not just concepts but demonstrations of actual transactions using new models – like credit card integrations that remove carbon with every purchase or sponsor-funded carbon-negative services.

These orchestrated moments transform market perception by showing a new approach is not just possible but inevitable.

The Path Forward: Creating Value, Not Just Offsetting

In a perfect world, governments would invest heavily in carbon removal as essential infrastructure, treating it like waste management – a public service we collectively fund. But our current geopolitical reality makes this unlikely in the near term.

Instead, we need to build a ground-up version that can scale to hundreds of millions of tonnes in the next 5-10 years through approaches that create value rather than just offset emissions:

Credit card transaction integrations that remove carbon with every purchase

Background removal via sponsorship models (like carbon-negative Uber rides)

Loyalty programs that convert points to removal

Consumer products with embedded removal as a premium feature

These distributed approaches must bridge the gap until more systematic government approaches become viable.

The Time for Category Creation Is Now

The carbon removal industry stands at a critical juncture. We've diagnosed the fundamental flaws in our current market design. We've recognized that tinkering with the existing system won't get us to scale.

Now it's time to create something new – to design a category specifically built for atmospheric impact rather than corporate accounting. This isn't just about creating better carbon removal companies – it's about making carbon removal itself inevitable and obvious.

The question isn't whether we have the technologies to remove carbon at scale. The question is whether we have the vision to create a category that enables those technologies to fulfill their potential.

Start Here: Taking Action on Category Creation

Ready to apply these principles to your work in carbon removal? Here are three concrete steps you can take this week based on your role in the industry:

For CDR Technology Providers

Redefine your customer profile: Map three potential buyers outside of sustainability departments (product, marketing, brand) who could benefit from your technology, and how their decision criteria differ from CSOs.

Create your "atmospheric impact" metrics: Develop 2-3 alternative metrics that showcase your scaling potential rather than just permanence or precision. What could you measure tomorrow that actually predicts gigatonne-scale potential?

Prototype a value-creating integration: Sketch a consumer product integration where your removal creates tangible value rather than just offsetting emissions. Think loyalty points, premium features, or branded experiences.

For Marketplaces and Facilitators

Segment your buyer personas: Create detailed profiles of three non-traditional buyer types (CMOs, product managers, consumer brands), including their priorities, budgets, and decision frameworks.

Develop your language playbook: Draft new terminology that escapes the offset trap. Replace "carbon credits," "offsetting," and "retirement" with terms that create mental space for new approaches.

Design your first alternative transaction model: Prototype one non-offset business model that connects removal to existing consumer spending. This could be a sponsorship model, integrated API, or loyalty program.

For Investors and Corporate Buyers

Map your atmospheric impact portfolio: Evaluate your current approach using a three-dimension framework: permanence, scale potential, and resilience to market shifts. What mix would maximize atmospheric impact?

Identify your integration opportunities: List three existing products, services, or customer touchpoints where carbon removal could create additional value beyond offsetting.

Connect with your marketing team: Schedule a joint workshop with your marketing department to explore how carbon removal could enhance brand value, customer loyalty, or premium offerings.

The key is taking that first step this week. Don't wait for someone else to create this category – be the one who leads it.

Related:

Embedding Carbon Removal Everywhere

If you read my last article on making carbon removal antifragile, you know I believe we've hit the limits of our current market design. The corporate offsetting model – where a few tech companies fund removal through their sustainability departments – simply can't get us to gigatonne scale.